Why am I objecting to the 2020-21 accounts for Merseyside Police and the Office of the Police and Crime Commissioner for Merseyside?

By John Brace (Editor)

and

Leonora Brace (Co-Editor)

First publication date: Friday 27th August 2021, 1:12 PM (BST).

Below is a copy of an objection I will be emailing later today to the auditor Grant Thornton about the 2020-21 accounts of Merseyside Police and the Office of the Police and Crime Commissioner for Merseyside.

Dear Michael Green (Grant Thornton) michael.green@uk.gt.com ,

CC: John Riley (PCC Chief Finance Officer) John.Riley@merseysidepcc.info

CC: Keith Dickinson (Director of Resources) Keith.Dickinson@merseyside.police.uk

I am a local government elector registered to vote at Jenmaleo, 134 Boundary Road, Bidston, Wirral, CH43 7PH (which means I am an elector within the electoral area covered by Merseyside Police/Office of the Police and Crime Commissioner for Merseyside). During the public inspection period I inspected various invoices paid by the Office of the Police and Crime Commissioner for Merseyside and invoices paid by Merseyside Police.

Section 26(2) of the Local Audit and Accountability Act 2014 allows me to question the auditor about these accounting records and section 27 of the Local Audit and Accountablity Act 2014 allows me to object if an item of spend is either unlawful (see section 28) or a matter in respect of which the auditor could make a public interest report. These questions/objection potentially fall within both categories.

Background

Both Merseyside Police and the Office of the Police and Crime Commissioner have paid for work during the 2020-21 financial year with limited companies known as personal service companies (by that I mean a company wholly owned by an individual). As far as I know, both police and crime commissioners in England and a chief officer of a police force in England are both public authorities covered by the off-payroll working rules (known as IR35). Therefore both have to make IR35 determinations as to whether the off-payroll working rules apply. If the rules apply an amount is deducted from that invoiced to pay Income Tax, employee National Insurance contributions, employer National Insurance contributions and Apprenticeship directly to HMRC.

In each of the examples below, the amount invoiced is the amount paid, therefore the following questions/objection arise (for each example given):-

1) Did Merseyside Police (or the Office of the Police and Crime Commissioner for Merseyside) correctly determine the IR35 status of these contractors?

2) If the answer to Q(1) is no, then when will Merseyside Police (or the Office of the Police and Crime Commissioner for Merseyside) pay the outstanding amounts to HMRC?

3) If the answer to Q(1) is no, then have IR35 determinations been done incorrectly going back to the requirement to first do so in 2017 and if so what is the quantum of the outstanding tax liability and should any such contingent liability be reflected in the statements of account for 2020-21?

4) If the answer to question (1) is yes, then please provide reasons why (with reasons given for each contractor).

Office of the Police and Crime Commissioner for Merseyside

Rene Barrett Limited

Rene Barrett is wholly owned by Mrs Irene Alicia Bennett (therefore is a personal service company). During 2020/21, the Office of the Police and Crime Commissioner for Merseyside was invoiced for £1,473.48 of work. £1,473.78 was paid, when asked about this the OPCC responded with “the OPCC engaged Rene Barrett Limited to provide a bespoke wellbeing session, as this was a one-off arrangement it was considered to fall outside the scope of IR35”.

Spring Associates Limited

Spring Associates Limited is wholly owned by Mr Edward Finlay (therefore is a personal service company). During 2020/21, the Office of the Police and Crime Commissioner for Merseyside was invoiced for £720, £600 and £540 worth of work for design and artwork. All 3 invoices were paid in full.

Glow New Media Limited

Glow New Media Limited is wholly owned by Mr Phillip Edward Blything (therefore is a personal service company). During 2020/21, the Office of the Police and Crime Commissioner for Merseyside was invoiced for £6,190.80, £3,095.40, £2,371.80, £1,440, £964.80, £844.20 and £624 for various pieces of work on websites. All associated invoices were paid in full.

Merseyside Police

Just Recruit Group Limited

Just Recruit Group Limited is wholly owned by Mr Brett Lee Edyvane (therefore is a personal service company). During 2020/21, Merseyside Police were invoiced for £1,051.08 and £2,987.28 for temporary staff. These invoices were paid in full (although the payments list list the payments as to Achieva Group Ltd rather than Just Recruit Group Limited).

Addtime Recording Limited

Addtime Recording Limited is wholly owned by Mr Peter Hilton (therefore is a personal service company). During 2020/21, Merseyside Police were invoiced for £4,306.80 for a maintenance agreement. The invoice was paid in full.

Advance Laparoscopic Surgery Ltd

Advance Laparoscopic Surgery Ltd is wholly owned by Ashraf Rasheed (therefore is a personal service company). During 2020/21, Merseyside Police were invoiced £1,620. The invoice was paid in full.

Alpine Vending Company Ltd

Alpine Vending Company Ltd is wholly owned by Mr John Francis Hazelhurst (therefore is a personal service company). During 2020/21, Merseyside Police were invoiced £12,600.

Anthony Dever Construction Ltd

Anthony Dever Construction Ltd is wholly owned by Mrs Donna Ann Dever. During the 2020/21 financial year, Merseyside Police were invoiced a total of £1,333,856.07.

ARB Consultancy & Training Ltd

ARB Consultancy & Training Limited is wholly owned by Mr Anthony Robert Barton. During the 2020/21 financial year, Merseyside Police were invoiced £2,700 by this company.

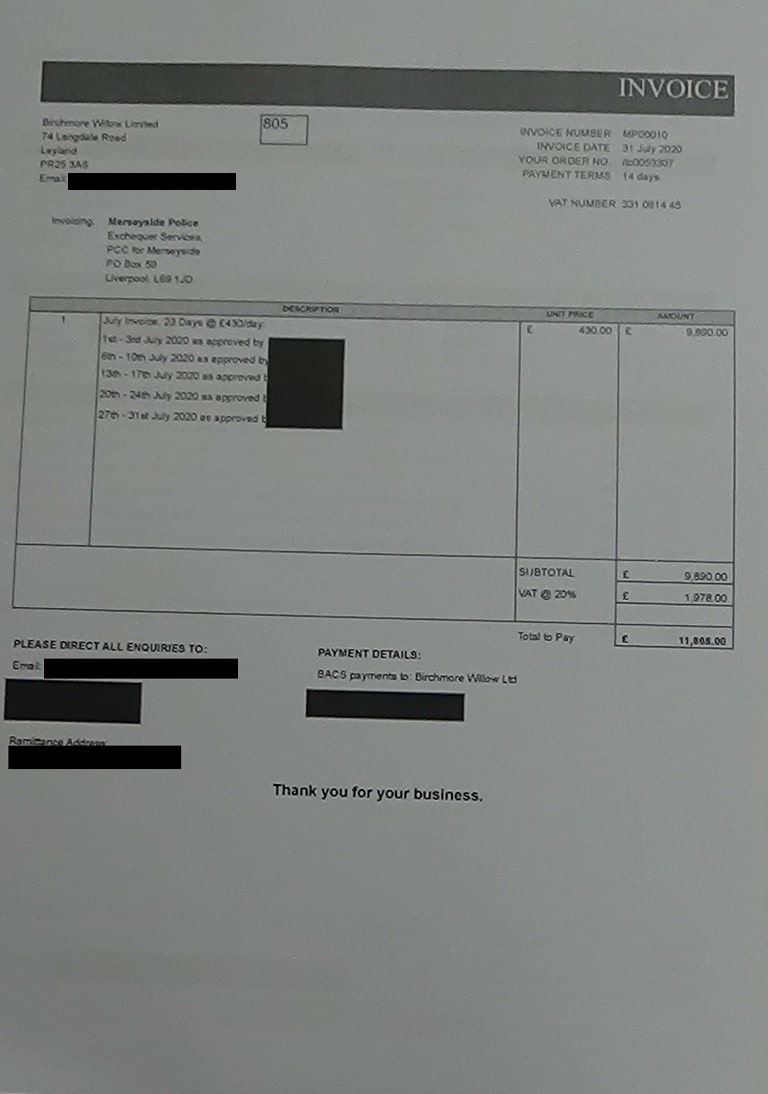

The above are a few examples for Merseyside Police as it would not be possible to submit these questions/objection by the statutory deadline of 4 pm if I was to create a full list for Merseyside Police. However to give one example from the rest Birchmore Willow Limited (wholly owned by Mrs Ingrid Tristina Bidle) invoiced Merseyside Police for £133,364 of work during 2020/21.

I look forward to reading a response from the auditors on the above with interest and remind Grant Thornton of the new timescales in the Code of Audit Practice for considering both eligibility of objections and if determined eligible an upper time limit on making a determination on the objection itself.

Although I have photos of the invoices in question that are mentioned above, I have not attached copies to prevent this email ending up in a spam folder and not being read – the paper copies held by Merseyside Police and the Office of the Police and Crime Commissioner for Merseyside are probably far easier to read the detail than my photos of the invoices are.

Yours sincerely,

John Brace

If you click on any of the buttons below, you’ll be doing me a favour by sharing this article with other people.

Keep up the good work John.

Thanks for the kind comment.

Investigative journalism on a level the Echo couldn’t cope with.

They can’t cope with the level of detail John digs up. They are lazy and report based on hearsay and personal opinions. No fact checking appears to take place.

Great work John and Leonora.