Has Liverpool City Region Combined Authority been paying the right amount of income tax and national insurance on payments to personal service companies?

This is a rather complicated story involving the Liverpool City Region Combined Authority (LCRCA) and one of its contractors called Green Blue Skies Limited that I will do my best to explain as well as I can.

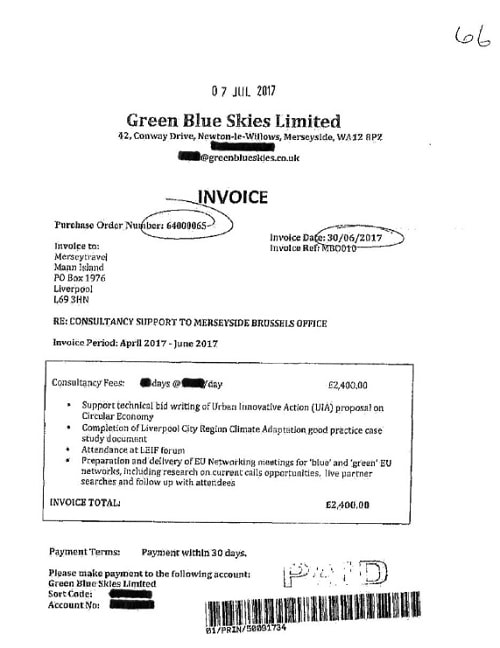

Earlier this week following a request for information to the Liverpool City Region Combined Authority I received a copy of an invoice dated 30th June 2017 from Green Blue Skies Limited for £2,400 for consultancy work.

A copy of the invoice (partly redacted) is below.

Green Blue Skies Ltd (according to Companies House) is owned by its sole director Mrs Victoria Jane Kelly.

It’s a personal service company that provides professional services (as detailed on the invoice) to clients (in this case the Liverpool City Region Combined Authority).

In LCRCA’s response to my request they incorrectly state, “In the case of Green Blue Skies Ltd., the company was a sole trader”.

As being paid for work through a limited company compared to being an employee of the Liverpool City Region Combined Authority led to tax advantages, in February 2017 Her Majesty’s Revenue and Customs (HMRC) issued guidance on what is termed off-payroll working rules.

The upshot of the guidance is that from February 2017 in relation to personal service companies providing services to public authorities such as the LCRCA was that when the off-payroll working rules applied the following should happen. Once the public authority was invoiced, the public authority would deduct the equivalent in tax and national insurance as if the person had been an employee from any payment made to the personal service company.

This invoice is for £2,400. The list of payments that the LCRCA made in July 2017 published on Merseytravel’s website (on page 5) show that the amount paid was £2,400.

I just don’t understand why the two figures match when according to the guidance LCRCA should have deducted tax and national insurance from the amount paid?

Perhaps you could find out for me why and leave a comment?

Contact details for LCRCA’s Treasurer and external auditors are below.

John Fogarty (LCRCA Treasurer) john.fogarty@merseytravel.gov.uk

External Auditors to the LCRCA (Mazars)

Gareth Hitchmough Gareth.Hitchmough@mazars.co.uk

Chris Whittingham Chris.Whittingham@mazars.co.uk

Patrick McCloskey Patrick.Mccloskey@mazars.co.uk

If you click on any of the buttons below, you’ll be doing me a favour by sharing this article with other people.

This lady would be self employed so its up to her to pay her own income tax and stamp!

But if someone has made a cock up in someway with regards to money owning or tax to be paid, we the council tax payer will pick up the bill, like we do every other time there’s a cock up, no worry services are cut and nothing gets done, using all the money saving the council backsides again

Thanks for your comment.

As the woman owns the company and is also a company director she could be paid in one of two different ways (or some one way and some the other way).

She could pay herself dividends from the profits of the company (which are taxed completely differently to self-employed earnings) and’or she could receive an amount as company director.

As a company director she would be taxed at the same rate as an employee (not at the self-employed rate).

So either way, whether through dividends or as a company director, she’s not taxed as a self-employed person.

The point is as she owns the company she could take her whole amount as dividends and avoid paying any payroll taxes as a company director altogether.