EXCLUSIVE: Leaked minutes of Merseyside Pension Fund’s Investment Monitoring Working Party held on the 17th September 2015

I will start off by declaring an interest as I have a close relative paid a pension by the Merseyside Pension Fund (which Wirral Council administers). My second declaration of interest is that in the section 6. Notes Action Points or Discussion Points, the reason for the extraordinary meeting of the Pensions Committee held on the 28th September 2015 was to resolve my objection to the 2014/15 accounts.

These are leaked minutes as only the first page comprising a list of those present, apologies and declarations of interest was published by Wirral Council as an appendix to this report considered by the Pensions Committee at its meeting on the 16th October 2015.

Below are the minutes of Wirral Council’s Investment Monitoring Working Party meeting held on the 17th September 2015.

Minutes of Investment Monitoring Working Party,

17th September 2015

In attendance:

| (Chair) Councillor Paul Doughty (WBC) | Peter Wallach (Head of MPF) |

| Councillor Geoffrey Watt (WBC) | Joe Blott (Strategic Director Transformation and Resources) |

| Councillor Cherry Povall (WBC) | Leyland Otter (Senior Investment Manager) |

| Councillor Pat Cleary (WBC) | Greg Campbell (Investment Manager) |

| Councillor Adrian Jones (WBC) | Susannah Friar (Property Manager) |

| Councillor Brian Kenny (WBC) | Adil Manzoor (Tax Accountant) |

| John Raisin (Chair of Pension Board) | Noel Mills |

| Donna Ridland (Pension Board) | Rohann Worrall (Independent Advisor) |

| Louise-Paul Hill (Aon Hewitt) | |

| Emma Jones (PA to Head of Pension Fund) |

Apologies were received from:

| Councillor Ann McLachlan (WBC) | Councillor Paulette Lappin |

Declarations of Interest

Councillor Paul Doughty declared an interest due to a relation being a beneficiary of Merseyside Pension Fund.

Councillor Geoffrey Watt declared an interest due to a relation being a beneficiary of Merseyside Pension Fund.

Introduction

1. Minutes of the meetings held on 16 April 2015.

Action points

None.

2. External Manager Presentations part 1

The Nomura Portfolio Review was presented by Masaaki Tezuka (MT) the Chief Portfolio Manager (Japan) and Andrew Whitaker (AW) Head of Relations (UK). AW introduced the themes of the presentation and MT gave the performance overview and answered questions from the panel.

A discussion ensued with regard to the investment performance and the market review of the year to June 2015. The profits among Japanese manufacturers were debated and it was expressed that it is concealing the weakness in exports. MT stated that exports have been reduced but this is expected to pick up. The competitiveness against the Asian markets was quite strong due to the exchange rate of the yen. It was further discussed that the Japanese market is lagging behind the US and European market.

Action points

None.

3. External Manager Presentations part 2

Patrick Vermulean (PV), Paul Shutes (PS) and Monique Stephens presented their European equities review and reported on performance and current portfolio positioning. PV explained that Paul Shutes is replacing Nick Wilcox and will assume the responsibility for the client management of the mandate.

A discussion ensued with regard to Ryanair and their outlook for the future. It was explained that Ryanair have changed their focus toward the customer and are addressing their business and website to improve the overall service to create a better business model akin to Easyjet.

PV discussed how they endeavour to ‘take the noise out of the market’ by monitoring earnings consensus and broker analysis; looking at normal distribution to find stocks between two extremes. PV asserted that they have good contacts with management and use a consensus to take companies out of the equation. However, when companies are all moving in the same direction the signal can be weak.

Action points

None.

4. Quarterly Review

PJW presented the Quarterly Review which covered themes such as the collapsing values of Chinese equities, sovereign bond markets and global monetary policy. PJW asserted that Greece was the dominant theme overall.

PJW reported on a number of issues including global government bond markets and the performance of risk assets. The value of the fund and the funding position was looked at and the performance of the Fund over the quarter and over 1 and 3 years. The asset allocation and MTAA including the MTAA panel meeting on 16 June 2015 were also reported on.

A discussion ensued with regard to the formulation of the benchmark and the strategy of the asset allocation. It was stated that the benchmark is reviewed on an annual basis and the Independent Advisors also offer guidance on this process.

Action points

None.

4.2 Market Commentary

Noel Mills (NM) gave a market commentary and reported on the market background which has been affected by the decline of the global equity market post the second quarter. This is largely a result of the Chinese equity bubble bursting and the renewed possibility of a Greek default which could see a postponement of the US economy moving to higher interest rates. The volatility of the markets continues and US monetary policy is set to tighten.

Action points

None.

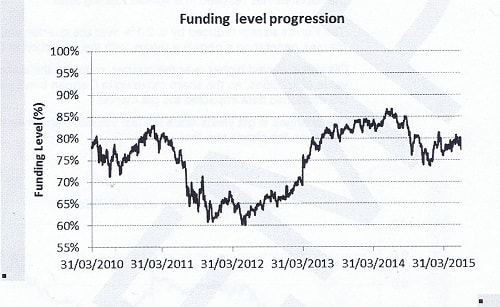

4.3 Aon Hewitt Update

Louis-Paul Hill (LH) presented the Strategic Monitoring Report of Aon Hewitt to members. Within his report he gave a funding level update which looked at how the estimated funding level has progressed since the 2010 valuation. The risk analysis, asset allocation, investment outlook and ideas and current research were also reported on.

An extract from that report follows below:

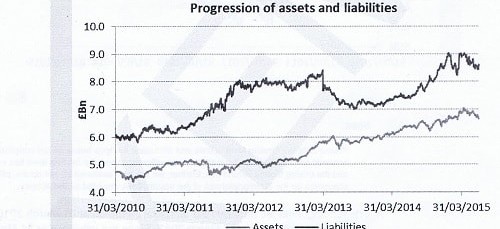

Funding Level Update

Introduction

progressed over the period from 31 March 2010 to 30 June 2015. lt also provides an attribution analysis of the changes in the funding level.

Mercer, the Fund’s actuary, has provided information regarding the Fund’s liabilities. The estimated funding level has been updated to account for the finalised valuation results from 31 March 2013.

Notes:

Using "like for like" assumptions (based on the assumptions from 31 March 2013) the funding level at 30 June 2015 remains broadly unchanged over the quarter at 77%.

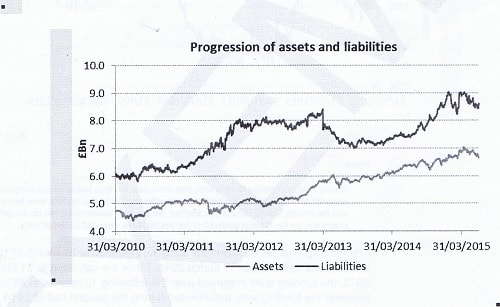

Asset and Liability progression

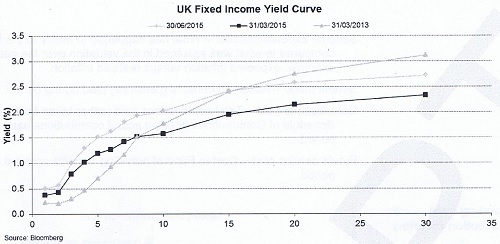

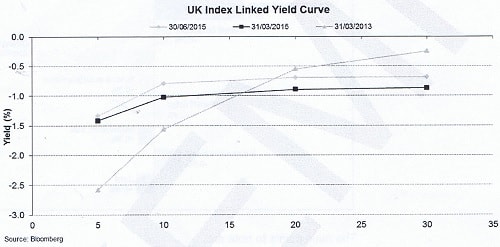

The liabilities increased in value significantly between 31 March 2011 and 31 December 2012, mainly due to falling gilt yields. For a year following the 31 March 2013 valuation, the present value of calculated liabilities reduced, when the prospect of tapering (a reduction of quantitative easing) caused gilt yields to rise. However, in the second half of 2014 this reversed, as gilt yields moved dramatically lower due to the falling oil price and uncertainty in Europe, resulting in the present value of liabilities rising above 31 March 2013 valuation levels.

While asset performance has been strong, the movement in the value of the liabilities has resulted in a volatile funding level.

The Fund’s assets reduced by c. 2.1% over the quarter, with all asset classes generating a negative return, with the exception of Property.

Gilt yields moved higher over the quarter, reducing the discounted present value of liabilities, as the sharp move up in German bond yields and mixed US economic data impacted the gilt market.

The changes in gilt yields since the last valuation and over the quarter are shown on the charts overleaf.

Reasons behind the change in funding level

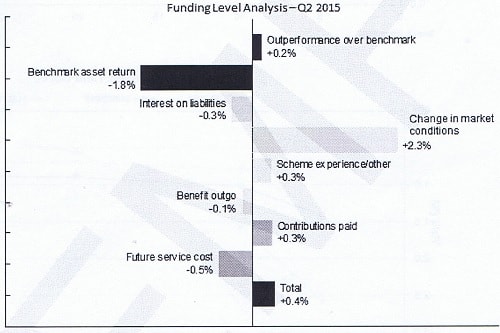

The chart overleaf decomposes the change in the funding level over the quarter across the various contributing factors. The contributing factors are:

Outperformance over benchmark — Approximate impact of any outperformance (underperformance) relative to the assets’ benchmark return.

Benchmark asset return – Approximate impact of the strategic benchmark return over period.

Interest on liabilities – Given that liabilities are due to be paid at fixed points in the future, as we move closer to the time of payment, these liabilities are discounted for one quarter less thus increasing their value (all other market conditions equal). The Fund must achieve this return to keep the funding level unchanged (everything else being equal).

Change in market conditions – Change in discount rate in this period due to changes in gilt yields and inflation expectations.

Scheme experience/other — What has happened in reality to the Fund compared to what was assumed in the valuation over the period. For example, expected inflation versus realised inflation.

Benefit outgo – Assumed benefits (pensions) paid during period.

Contributions paid – Total contributions paid (either taken from the Schedule of Contributions or using actual contributions paid) during period.

Future service cost — Cost to Fund of providing benefits accrued over period.

Funding level attribution (quarter)

The overall effect of the strategic benchmark asset return was a negative impact on the funding level of 1.8%.

Outperformance by managers versus their benchmarks increased the funding level by 0.2%.

Interest accrued by rolling the liabilities forward over the quarter has reduced the funding level by 0.3%.

The majority of the liabilities are real (or index linked) in nature and therefore changes in the real yield will have a large effect. The result of a continued fall in yields over the quarter is shown by a 2.3% increase in the funding level. This is called the "change in market conditions".

Contributions paid resulted in an improvement of 0.3% in the funding level. Benefit payments and future service costs reduced the funding level over the period by a further 0.1% and 0.5% respectively.

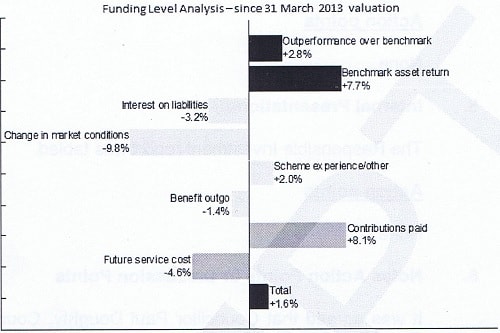

Funding level attribution (since 2013 valuation)

The Fund’s assets and investment managers have performed strongly since the valuation.

Interest accrued by rolling the liabilities forward has reduced the funding level although the major negative impact on funding level has come from changes in the market conditions (falling gilt yields).

Contributions paid resulted in a large improvement including the lump sum paid in Q2 2014 with benefit payments and future service costs reducing the funding level.

Action points

None.

4.4 Valuation and Performance Summary including Monitoring Report

LO reported on the monitoring reported quarter 2 and noted there were some minor differences in figures produced due to reconciliation issues.

The valuation of the fund as at 30 June 2015 stood at £6.6bn and ahead of its benchmark by 0.19% returning -2.07% against the benchmark of -2.26%. The performance of the mandates was looked at to 30 June 2015. The performance of the majority of external managers has been good but M&G Recovery and M&G EM Equity continue to lag and are being monitored by the Fund.

Amundi and Legal & General Active Fixed Income continue to be on Watch status.

Action points

None.

5. Internal Presentations

The Responsible Investment report was tabled.

Action points

None.

6. Notes Action Points or Discussion Points

It was agreed that Councillor Paul Doughty, Councillor Treena Johnson, Councillor Pat Cleary and Councillor John Fulham would make up the Task & Finish Group to review the status of ethical investments and to coordinate a public message. EJ to arrange a suitable date.

An extraordinary meeting of Pensions Committee has been arranged for the 28 September 2015 to gain approval of the Annual Report.

Action points

None.

6.1 Noting items

Task & Finish Group to meet.

Extraordinary meeting of Pensions Committee 28 September 2015.

6.2 Action points

EJ to arrange suitable date of Task & Finish Group.

6.3 Summary of Recommendations

None.

6.4 Discussion Points (including any other business)

None.

5.1 Action Points

None.

Date of Next Meeting

Thursday 8 October 2015 at 10.00 am, 6th floor, Cunard Building.

If you click on any of the buttons below, you’ll be doing me a favour by sharing this article with other people.