What links FOI, ICO decision notice FS50591795, audit, a class A drug, barristers and Liverpool City Council?

There is a form of direct accountability during the audit of local councils when for a short period each year local government electors can inspect information about that financial year such as invoices and contracts.

Here is a legal reference to that right (Audit Commission Act 1998, s.15) which has been a direct form of democratic accountability that in one form or another has been around since Victorian times.

It’s tied in to rights of local government electors to ask questions of the external auditor (which for Wirral Council is Grant Thornton), to make objections to the accounts, to request public interest reports. After all how can you do all that without seeing the information in the first place?

It’s a form of direct democratic accountability.

Unlike making a freedom of information request (time limit of 18.5 hours) there is strictly very little legal limits on what can be requested (well apart from on the insular peninsula at Wirral Council where they have a habit of deliberately shifting the goalposts and coming up with bizarre interpretations of legislation to suit themselves). Last year I made requests under this audit legislation to Wirral Council, Liverpool City Council, Merseyside Waste Disposal Authority, Merseytravel and the Merseyside Fire and Rescue Authority.

The Liverpool City Council request was connected to an earlier FOI request and there’s been a recent decision notice issued in that matter on the 1st February 2016 which hasn’t been published yet by ICO.

Ironically ICO seemed to have met a stumbling block with Liverpool City Council on that one as they asked me for the information that I’d been refused under FOI (happy to oblige). This implies Liverpool City Council weren’t being entirely cooperative with ICO.

I’ve been sent a paper copy of the decision notice through the post, but it’s not published on ICO’s website yet. The reference is FS50591795. It’s a mercifully short eight pages and requires both Liverpool City Council to issue a fresh response with 35 days of 1st February 2016 (or appeal to the Tribunal) and states that Liverpool City Council breached s.10(1) of the Freedom of Information Act 2000. If anybody wants me to I can scan a copy in and publish it here.

Basically LCC’s arguments are that I’m being unfair to barristers by requesting invoices they’ve submitted to LCC. Because as we all know, the purpose of a self proclaimed "socialist" Council like Liverpool City Council is to stick up for downtrodden, oppressed groups on the margins of society like barristers!

Let’s take the example of one barrister (pictured above on the left), a barrister I might point out who is not the subject of the invoices I requested, but who is in addition to being a barrister, a Labour Liverpool City Council councillor called Cllr Paul Brant. He resigned as a councillor in 2013 (although has since been re-elected) after receiving a police caution for possession of a class A drug. He was also the subject of a The Bar Tribunals & Adjudication Service disciplinary tribunal.

Below are the details.

Type of hearing 3 Person Disciplinary Tribunal

Panel members

Mr William Rhodri Davies QC (Chair)

Ms Pamela Mansell

Mr Mark West

Finding and sentence Reprimand.

Section of the code 301(a)(i)/901.7

Status Final

Date Friday 12 September 2014

This Tribunal was held in Private.

Here is a link to the outcome of the Paul Brant disciplinary hearing from which I quote,

"Details of Offence

Paul Brant engaged in conduct which was discreditable to a barrister contrary to paragraph 301(a)(i) of the Code of Conduct in that on a day between the 1st January 2013 and the 21st September 2013 he committed the criminal offence of being in possession of a controlled drug of class A contrary to The Misuse of Drugs Act 1971, for which offence on the 20th September 2013 he receive a simple caution."

It would be a conflict of interest for Cllr Paul Brant to do work for Liverpool City Council but according to his Chamber’s website he has been instructed to represent Wirral Council in the past (yes Wirral Leaks I can get trees into a story too!):

This is an aside but I do remember one year during the audit, Wirral Council weren’t happy with me requesting the invoices for their legal invoices for these sorts of liability claims. “

However there should be some transparency as to who Liverpool City Council are paying! All Liverpool City Council councillors are responsible for budget matters including Cllr Paul Brant.

One of my arguments rejected by ICO was that there are laws regulating who can give legal advice. You can check whether a barrister has a current practising certificate here.

To give the example of Paul Brant above, it shows he works at Oriel Chambers and was subject to a disciplinary tribunal in September 2014 (the outcome of which is detailed above).

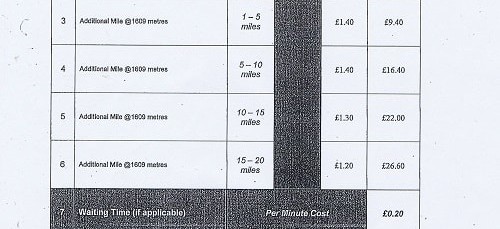

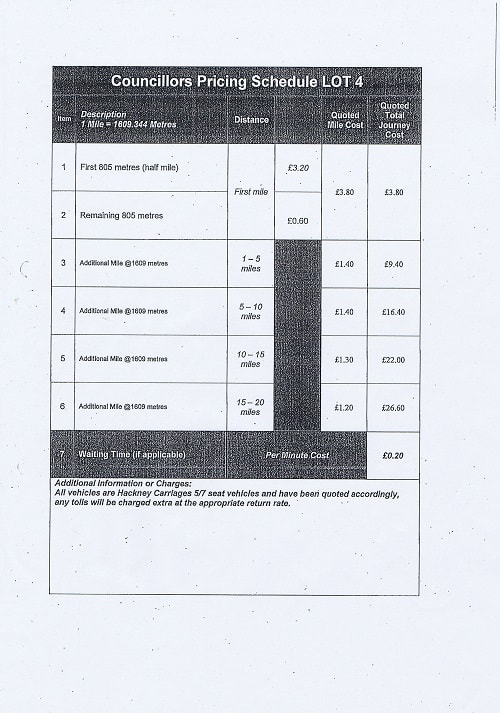

One of my other arguments to the regulator was that Liverpool City Council is under a legal obligation to publish the names of its suppliers for invoices over £500. In fact the guidance they’re required by law to follow specifically states that being self-employed (which is their argument surrounding barristers) doesn’t mean they can keep the suppliers’ name out of the public domain (but Liverpool City Council do).

The page on his Chambers’ website states he is "in a senior position in a large local authority" (meaning Liverpool City Council).

However the above legislation (surrounding rights of inspection, objection etc) during the audit was scrapped by the government. You can’t use it any more to do this after the 2014/15 financial year.

Instead for 2015/16 financial year onwards it’s been completely watered down.

Previously (apart from information about its own staff) local councils during the audit had to get permission from their external auditor if they wanted to withhold from inspection in the category of "personal information" (which was very narrowly defined). This was a safeguard to prevent public bodies abusing their powers.

Bear in mind however that each time the public body contacts their external auditor it increases what they’re charged.

This was a check and balance introduced by the last Labour government.

However this check and balance on misuses of power in local government was repealed (scrapped) by the last Coalition government (Conservative/Lib Dem).

Oh but there’s more!

There’s a rather infamous recent case (well infamous in those familiar with "citizen audit") where a local government elector called Shlomo Dowen requested (during this period each year during the audit) a waste management contract between Nottinghamshire County Council and Veolia ES Nottinghamshire Ltd.

The case reference is [2009] EWHC 2382 (Admin), [2010] PTSR 797, [2010] Env LR 12. Anyway interestingly at that stage a High Court Judge said Mr. Shlomo Dowen should be allowed to inspect and receive a copy of the contract (despite Veolia bringing a judicial review about it).

However Veolia weren’t happy at all by this (in fact if you read through the judgements in both cases you’ll find that even if Mr. Dowen was given the contract they wanted restrictions on him sharing it with other people) and brought an appeal in the Court of Appeal ([2010] EWCA Civ 1214, [2012] PTSR 185, [2010] UKHRR 1317, [2011] Eu LR 172). Veolia claimed that allowing Mr. Dowen to inspect/receive a copy of the contract would infringe that companies’ human rights.

I quote from part of that judgement, “I am not entirely convinced that English common law has always regarded the preservation of confidential information as a fundamental human right”.

Rix LJ, Etherton LJ, Jackson LJ upheld the appeal however.

The irony of all that was that Shlomo Dowen already had access to the information as Veolia’s lawyers did not seek a stay following the earlier judgment.

However the above is why an extra category of "commercial confidentiality" has now been added to s. 26(5) of the Local Audit and Accountability Act 2014.

Interestingly withholding information on grounds of commercial confidentiality, this is a quote from the legislation,

(a) its disclosure would prejudice commercial confidentiality, and

(b) there is no overriding public interest in favour of its disclosure.”

is subject to a public interest test.

However there are other changes on the horizon too. Previously the inspection period was 15 days (3 weeks assuming there are no holidays).

When that inspection period was published in a public notice in at least one newspaper in the area and on the public body’s website.

I only have until the end of the 2015/16 local government financial year to get up to speed on these changes as being the Editor here I’ll have to schedule time for responding to the public notices, arranging appointments to inspect, as well as spare capacity for dealing with the moaning of the public sector (example moan last year being, it’s been 7/8 years since someone did this!).

As Wirral Council was somewhat uncooperative last year over the size of my request (only responding to the 10% of it they didn’t deem to be particularly sensitive), I will be having internal discussions here on avenues that can be explored to either embarrass Wirral Council into legal compliance (by censure (not to say that always works) or take more formal action.

Weirdly some of the politician’s expenses that they refused me under the audit legislation and Cllr Adrian Jones refused to make an appointment for me to see, they released in response to a later FOI request.

Which just goes to show that if you ask for the same information three times from Wirral Council (audit rights, a politician, then FOI), you might finally get it! Obviously by the third time, it starts to get embarrassing and seems like they have something to hide. I really don’t like having to ask three times when once should be enough though!

Anyway what was going to be only a short article about local government, barristers, ICO, FOI and audit is now rather on the long side so I’ll draw this to a close and give you an opportunity to comment.

If you click on any of the buttons below, you’ll be doing me a favour by sharing this article with other people.