Why am I angry at Wirral Council for allegedly breaking more laws to cover up a 3 year investigation and subsequent decision by three councillors as to why Councillor Steve Foulkes broke the Code of Conduct and should apologise for leaking information about Councillor Jeff Green to the press?

17/8/16 Amended to correct name of Phil Goodman to Peter Goodman.

Firstly, I’m cross with Wirral Council.

What is it this time you may wonder?

Well I have a long list of grievances, but not being a Wirral Council employee no formal route (ok I could bring some of these up with my trade union) to take these to a grievance hearing, nor the time or inclination at this stage to get the judiciary involved.

I’m cross at being shouted at by junior public facing employees of Wirral Council who I will gladly name here from what I remember as Shirley Hudspeth (Legal and Member Services) and Peter Goodman (whatever the facilities management side of Wirral Council is called as frankly I’ve lost track of restructures? Is it infrastructure, asset management something like that?) with their view that it was a private meeting, but I’m not cross at them in a major way because I’m more cross at what I presume are their senior manager/s or senior manager/s from another department at Wirral Council who told both of them to say this to me (even though it isn’t true) as it seems a senior manager/s at Wirral Council would stoop that low as to instruct junior employees to do what they (senior manager/s) should have the guts to do face to face themselves.

I’m cross at Wirral Council for its website not working as I write this at democracy.wirral.gov.uk so I can’t include links or refer to the details. But yeah, whoever’s job it is to fix it may be on holiday.

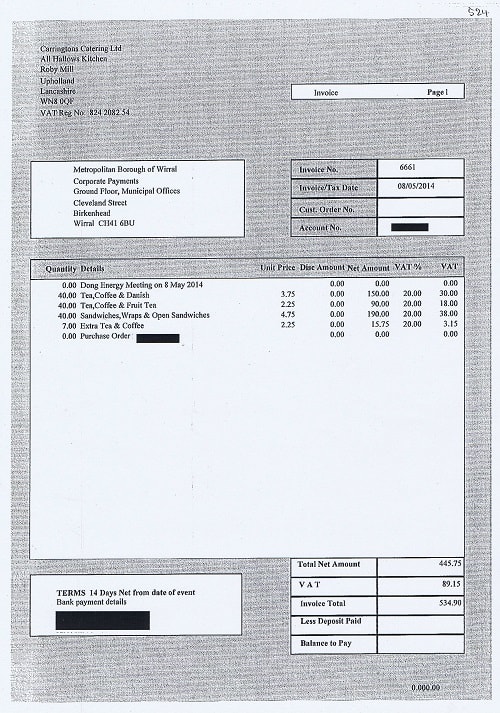

I’m cross at a senior manager (Joe Blott) and his external legal adviser (whose name I can’t recall without checking Wirral Council’s website that isn’t working). Yes the external legal advisor is the guy in this photo as I wasn’t allowed to be at or film him at the public bit of the Standards Panel meeting (and just as an aside this law allows me to film such public meetings even if I’m not physically in the room, which I suppose next time if I’m not allowed actually in the room for a public meeting I’ll have to do the filming either through the meeting room door or from the car park outside!)

However in Joe Blott’s defence I don’t think he understood why the legal advice he got was flawed and had the external legal advisor pointed out why it was flawed he’d have had to have criticised his client (Wirral Council) which is a big no-no if he ever wants further work from Wirral Council in the future.

I’m not cross with Surjit Tour who seems to have a conflict of interest. But if he does have one, Joe Blott is supposed to deal with it!!!

I am cross with the fact that 5 clear working days notice of the date, time, agenda and reports (if not recommended to be heard in closed session) for the Standards Panel meeting on the 28th June 2016 was not given by the 20th June 2016, but instead yesterday the 3rd of August 2016.

I’m cross that a complaint about a councillor (Cllr Steve Foulkes) as to what happened in July 2013 has taken Wirral Council around three years to resolve.

I’m cross that Patricia Thynne in her report refers to myself as having filmed a YouTube video referred to when I didn’t film it and it was indeed someone else! I’m also cross with myself that relying on Patricia Thynne’s report I then left a comment on the Wirral Leaks blog only to be embarrassed into being told it is a mistake in her report.

I’ve recently learned that Cllr Gilchrist was the Chair of the Standards Panel, I’m cross that I wasn’t allowed to go to the public bit of the Standards Panel meeting where this was decided on the 28th June 2016 to find this out and had to wait around a month to know whether it was Cllr Chris Blakeley or Cllr Phil Gilchrist.

I’m cross that in messing up what’s detailed above Wirral Council is relying on a legal power that was repealed years ago.

I’m cross that for reasons of internal capacity here I didn’t take things further over what happened to us at the meeting on the 28th June 2016 whether by letter or subsequent legal action against Wirral Council.

However, moving to the complaint itself, yes I was there in the public gallery in July 2013 in the adjournment while it happened. Yes Cllr Steve Foulkes came in and spoke with Liam Murphy (referred to as Person C). Yes, I was too far away (at the other end of the public gallery to hear what they were saying). Yes I remember Mr Nigel Hobro coming in to the public gallery at this point and wanting to speak with Liam Murphy but getting the brush off.

Yes, my opinion (not that it matters really) is that I think it is fair that Cllr Foulkes should apologise.

However, isn’t it ironic that as Cllr Foulkes previously made a complaint about Cllr Chris Blakeley talking to the Liverpool Echo about whether Cllr Foulkes should be made Mayor (a complaint that Cllr Chris Blakeley was cleared of as you can read about here) that Cllr Chris Blakeley should then be on the Standards Panel to decide about a complaint about Cllr Foulkes leaking information to a Liverpool Echo journalist? Or is that just karma?

Yes Person C in the report is Liam Murphy. Yes I feel sorry for him, yes it is a breach of journalistic ethics to reveal the source of information, but by the sounds of it he (Liam Murphy) was being used by Cllr Foulkes anyway for political gain.

As to the payoff to Emma Degg, her initial silence (prompted in part it seems by the payment of public money), followed by what I presume was a guilty conscience, well at least she finally did the right thing!

As to the allegation that witnesses “colluded” to bring down Cllr Foulkes, well Patricia Thynne feels this is not credible. I will comment however that unless you are in disguise, nobody knows what you look like or in an echo chamber, it’s frankly foolish in the extreme to bring up anything confidential (whether in conversation or by passing it to them) with a journalist when you have people watching you do it, in a public place, in a public building, in the adjournment to a high-profile public meeting.

However Cllr Foulkes’ explanation is he was under a lot of pressure.

Tip for people reading this, if you want in the future to leak something to me, there’s the post (probably the most secure method), email or telephone (if you want the intelligence agencies to read/listen to it in transit) or other ways of sending it to me online.

Yes you can talk to me or hand me things in person, but there are always people watching!

I did ask Cllr Steve Foulkes in person at the end of the Birkenhead Constituency Committee meeting on the evening of Thursday 28th July 2016 to comment on the complaint. He refused to comment directly on the matter (I presume following Mr. Tour’s advice to councillors to keep their mouth shut) and referred me to Wirral Council instead.

So yes, I’m still cross and Wirral Council is finally well dealing with what should’ve been done properly the first time!!!

By first time, I don’t just mean the original complaint (that this morphed into), but what happened at the Standards Panel meeting too.

If you click on any of the buttons below, you’ll be doing me a favour by sharing this article with other people.