Birkenhead Market Limited Accounts: Is This The Reason Behind Neptune’s Masterplan?

Following a previous story on this blog about Birkenhead Market, someone suggested I look at the accounts for Birkenhead Market Limited so I decided to request the latest set of accounts for Birkenhead Market Limited from Companies House.

The accounts make for very interesting reading and may be why Neptune Developments Limited was asked by Wirral Council’s Cabinet to come up with a master plan for Birkenhead Market.

A copy of the latest unaudited accounts (for the year ending 31st July 2012) are below.

Registered number: 04403580

BIRKENHEAD MARKET LIMITED

UNAUDITED

ABBREVIATED ACCOUNTS

FOR THE YEAR ENDED 31 JULY 2012

________________________________________________________________________________

BIRKENHEAD MARKET LIMITED

REGISTERED NUMBER: 04403580

________________________________________________________________________________

ABBREVIATED BALANCE SHEET

AS AT 31 JULY 2012

________________________________________________________________________________

|

|

|

2012 |

|

2011 |

|

Note |

£ |

£ |

£ |

£ |

| FIXED ASSETS |

|

|

|

|

|

| Intangible assets |

2 |

|

1 |

|

1 |

| Tangible assets |

3 |

|

1,741,325 |

|

1,799,446 |

| Investments |

4 |

|

1 |

|

1 |

|

|

|

_________ |

|

_________ |

|

|

|

1,741,327 |

|

1,799,448 |

| CURRENT ASSETS |

|

|

|

|

|

| Debtors |

5 |

26,148 |

|

36,138 |

| Cash at bank and in hand |

|

59,931 |

|

101,441 |

|

|

_________ |

|

_________ |

|

|

|

86,079 |

|

137,579 |

| CREDITORS: amounts falling due within one year |

6 |

(4,308,952) |

|

(4,365,582) |

|

|

|

_____________ |

|

_____________ |

|

| NET CURRENT LIABILITIES |

|

|

(4,222,873) |

|

(4,228,003) |

|

|

|

_____________ |

|

_____________ |

| NET LIABILITIES |

|

|

(2,481,546) |

|

(2,428,555) |

|

|

|

_____________ |

|

_____________ |

| CAPITAL AND RESERVES |

|

|

|

|

|

| Called up share capital |

7 |

|

10,000 |

|

10,000 |

| Profit and loss account |

|

|

(2,491,546) |

|

(2,438,555) |

|

|

|

_____________ |

|

_____________ |

| SHAREHOLDERS’ DEFICIT |

|

|

(2,481,546) |

|

(2,428,555) |

|

|

|

_____________ |

|

_____________ |

The directors consider that the company is entitled to exemption from the requirement to have an audit under the provisions of section 477 of the Companies Act 2006 (“the Act”) and members have not required the company to obtain an audit for the year in question in accordance with section 476 of the Act.

The directors acknowledge their responsibilities for complying with the requirements of the Companies Act 2006 with respect to accounting records and for preparing financial statements which give a true and fair state of affairs of the company as at 31 July 2012 and of its loss for the year in accordance with the requirements of section 394 and 395 of the Act and which otherwise comply with the requirements of the Companies Act 2006 relating to financial statements, so far as applicable to the company.

The abbreviated accounts, which have been prepared in accordance with the special provisions relating to companies subject to the small companies regime within part 15 of the Companies Act 2006, were approved and authorised for issue by the board and were signed off on its behalf on 24 April 2013.

(signature of LD Embra)

Mr L D Embra

Director

The notes on pages 2 to 5 form part of these financial statements.

________________________________________________________________________________

BIRKENHEAD MARKET LIMITED

________________________________________________________________________________

NOTES TO THE ABBREVIATED ACCOUNTS

FOR THE YEAR ENDED 31 JULY 2012

________________________________________________________________________________

1. ACCOUNTING POLICIES

1.1 Basis of preparation of financial statements

The full financial statements, from which these abbreviated accounts have been extracted, have been prepared under the historical cost convention and in accordance with the Financial Reporting for Smaller Entities (effective April 2008).

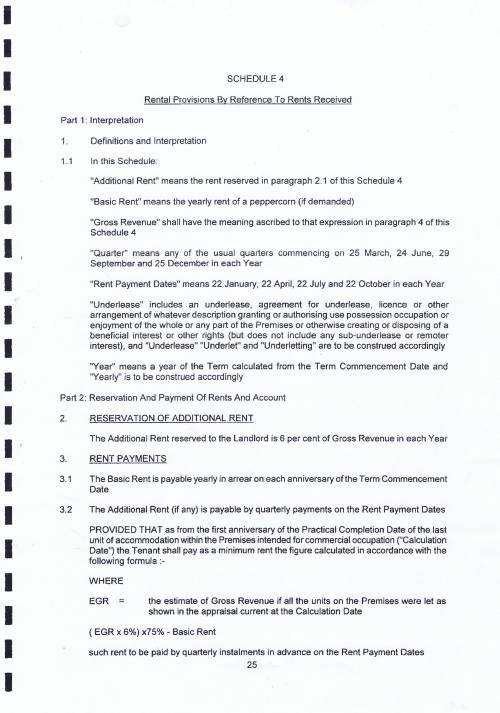

1.2 Going concern

The company meets its day to day working capital requirements through a combination of bank loans and overdraft facility. The company is currently in discussions with its bankers regarding the term of its loan and believes from current discussions with its bankers that the loan will be renewed on a basis that will enable the company to meet its liabilities as and when they fall due over at least the next 12 months. The financial statements do not include any adjustments that would result from the withdrawal of support from the company’s bankers. The directors therefore consider the going concern basis of accounting to be an appropriate basis to produce the financial statements.

While the company does have net liabilities at 31 July 2012 of £2,481,546, the balance sheet includes leasehold property at a historical cost carrying value of £1,683,406 in respect of an asset which is considered by the directors to have a considerably higher current market value.

1.3 Turnover

Turnover comprises revenue recognised by the company in respect of goods and services supplied during the year, exclusive of Value Added Tax and trade discounts.

1.4 Intangible fixed assets and amortisation

Goodwill is the difference between amounts paid on the acquisition of a business and the fair value of the identifiable assets and liabilities. It is amortised to the Profit and loss account over its estimated economic life.

1.5 Tangible fixed assets and depreciation

Tangible fixed assets are stated at cost less depreciation. Depreciation is provided at rates calculated to write off the cost of fixed assets, less their estimated residual value, over their expected useful lives on the following bases

L/Term Leasehold Property – 50 years straight line

Fixtures and fittings – 25% reducing balance

1.6 Investments

Investments held as fixed assets are shown at cost less provision for impairment.

________________________________________________________________________________

BIRKENHEAD MARKET LIMITED

________________________________________________________________________________

NOTES TO THE ABBREVIATED ACCOUNTS

FOR THE YEAR ENDED 31 JULY 2012

________________________________________________________________________________

2. INTANGIBLE FIXED ASSETS

|

£ |

| Cost |

|

| At 1 August 2011 and 31 July 2012 |

1 |

|

_________ |

| Net book value |

|

| At 31 July 2012 |

1 |

|

_________ |

| At 31 July 2011 |

1 |

|

_________ |

3. TANGIBLE FIXED ASSETS

|

£ |

| Cost |

|

| At 1 August 2011 |

2,747,799 |

| Additions |

2,250 |

|

___________ |

| At 31 July 2012 |

2,750,049 |

| Depreciation |

|

| At 1 August 2011 |

948,353 |

| Charge for the year |

60,371 |

|

___________ |

| At 31 July 2012 |

1,008,724 |

|

___________ |

| Net book value |

|

| At 31 July 2012 |

1,741,325 |

|

___________ |

| At 31 July 2011 |

1,799,446 |

|

___________ |

Under the small companies regime the company is exempt from preparing consolidated accounts and has not done so, therefore the accounts show information about the company as an individual entity.

3. FIXED ASSET INVESTMENTS

|

£ |

| Cost or valuation |

|

| At 1 August 2011 and 31 July 2012 |

1 |

|

___________ |

| Net book value |

|

| At 31 July 2012 |

1 |

|

___________ |

| At 31 July 2011 |

1 |

|

___________ |

________________________________________________________________________________

BIRKENHEAD MARKET LIMITED

________________________________________________________________________________

NOTES TO THE ABBREVIATED ACCOUNTS

FOR THE YEAR ENDED 31 JULY 2012

________________________________________________________________________________

4. FIXED ASSET INVESTMENTS (continued)

Subsidiary undertakings

The following were subsidiary undertakings of the company.

The aggregate of the share capital and reserves as at 31 July 2012 and of the profit or loss for the year ended on that date for the subsidiary undertakings were as follows.

| Name |

Aggregate of share capital and reserves |

Profit/(loss) |

|

£ |

£ |

| Birkenhead Market Services Limited |

189,459 |

(48,927) |

|

___________ |

___________ |

Under the small companies regime the company is exempt from preparing consolidated accounts and has not done so, therefore the accounts show information about the company as an individual entity.

5. DEBTORS

Included within other debtors are loans to the following related companies Liverpool Developments (2001) Limited, London Provincial and Overseas Limited, Europa Plaza Developments Limited, Jelder Consultants Limited and Landmark Projects and Developments Limited.

During the year to 31 July 2012 a provision was made against accrued interest of £12,600 due from Liverpool Developments (2001) Limited. Interest is charged on the fully provided outstanding loan balance at the rate of 7%. The charge for the year ended 31 July 2012 was £12,600.

During the year to 31 July 2012 a provision was made against accrued interest of £29,721 due from London Provincial and Overseas Limited. Interest is charged on the fully provided outstanding loan balance at the rate of 7%. The charge for the year ended 31 July 2012 was £29,721.

During the year to 31 July 2012 a provision was made against accrued interest of £735 due from Europa Plaza Developments Limited. Interest is charged on the fully provided outstanding loan balance at the rate of 7%. The charge for the year ended 31 July 2012 was £735.

During the year to 31 July 2012 a provision was made against accrued interest of £109,152 due from Jelder Consultants Limited. Interest is charged on the fully provided outstanding loan balance at the rate of 7%. The charge for the year ended 31 July 2012 was £109,152.

All of the above loans and associated accrued interest are still due and payable to the company. All amounts have been provided against on the grounds of prudence, due to uncertainty over recoverability.

________________________________________________________________________________

BIRKENHEAD MARKET LIMITED

________________________________________________________________________________

NOTES TO THE ABBREVIATED ACCOUNTS

FOR THE YEAR ENDED 31 JULY 2012

________________________________________________________________________________

6. CREDITORS

Amounts falling due within one year

The bank loan and overdraft facility are secured by a first legal charge over the property and its associated asset, debentures by, and unlimited cross guarantees by and between the Borrower and Birkenhead Market Services Limited and a guarantee for £150,000 by Mr L D Embra.

7. SHARE CAPITAL

|

2012 |

2011 |

|

£ |

£ |

| Allotted, called up and fully paid |

|

|

| 10,000 Ordinary shares of £1 each |

10,000 |

10,000 |

|

___________ |

___________ |

DIRECTOR’s BENEFITS: ADVANCES, CREDIT AND GUARANTEES

The balance on Mr D F Doyle’s loan account is £nil (2011 £4,588). The maximum amount due in the year was £4,588. No interest was charged during the year.

The balance on Mr J E Richardson’s loan account is £5,000 (2011 £3,000). The maximum amount due in the year was £5,000. No interest was charged during the year.

If you click on any of these buttons below, you’ll be doing me a favour by sharing this article with other people. Thanks:

53.402022-3.070415